- Faculty Members

- Faculty as Resources

- Faculty Publication

- Faculty Initiatives on Teaching – Learning

Dr. Vidya Nakhate

Director

Dr. Rekha Singh

Dy. Director & ProfessorDr. Shuchi Gautam

Professor

Dr. Shuchi Gautam

Professor

Dr. Swati Sabale

ProfessorDr. Ramkrishna Dikkatwar

Professor

Dr. Ramkrishna Dikkatwar

Professor

Dr. Vishal Rajendra Sandanshive

Professor

Dr. Chitra Gounder

Professor

Dr. Sonal Sharma

Associate Professor

Dr. (CA) Megha Sharma

Associate Professor

Dr. Rahul Wagh

Associate Professor

Dr. Nidhi Srivastava

Associate Professor

Dr. Mishu Tripathi

Assistant Professor

Ms. Lata Poojari

Assistant Professor

Mr. Ashish Kumar

Assistant Professor

Mr. Mahendra Daima

Assistant Professor

Dr.Triptii Shelkke

Assistant Professor

Mr. P. Thalhath

Assistant Professor

Mr. Anmol Dixit

Assistant Professor

Mr. Rahul Mehta

Asst. Prof., Head Industry Institute Connect and Placements

Dr. Ravikumar Gajbiye

Assistant Professor

Ms. Ketaki Shetye

Assistant Professor

Ms. Kinjal Shah

Assistant Professor

Ms. Reenakumari Shivnandan Gupta

Assistant Professor

Mr. Sandeep Dubey

Assistant ProfessorMr. Romil Parmar

Assistant Professor

Mr. Romil Parmar

Assistant ProfessorMr. Rohit Tiwari

Assistant Professor

Mr. Rohit Tiwari

Assistant ProfessorMr. Mangesh Pawar

Assistant Professor

Mr. Mangesh Pawar

Assistant ProfessorMr. Krunal Damania

Assistant Professor

Mr. Krunal Damania

Assistant ProfessorMr. Mahendra G Salunke

Assistant Professor

Mr. Mahendra G Salunke

Assistant ProfessorMr. Girish Vikas Korde

Assistant Professor

Mr. Girish Vikas Korde

Assistant ProfessorMr. Vishnu Vyas

Assistant Professor

Mr. Vishnu Vyas

Assistant ProfessorDr. Kaustubh Gondhalekar

Assistant Professor

Dr. Kaustubh Gondhalekar

Assistant ProfessorMr. Amit Gursale

Assistant Professor

Mr. Amit Gursale

Assistant ProfessorMs. Meghna Patil

Assistant Professor

Ms. Meghna Patil

Assistant ProfessorDr. Deepali Manjrekar

Assistant Professor

Dr. Deepali Manjrekar

Assistant ProfessorMr. Kirit Dhabalia

Assistant Professor

Mr. Kirit Dhabalia

Assistant ProfessorMr. Mayank Rathod

Assistant Professor

Mr. Mayank Rathod

Assistant ProfessorMr. Mukund Prakash Harne

Librarian

Mr. Mukund Prakash Harne

LibrarianDr. Rekha Singh, Dy. Director and Professor was honoured with the Mid-Day Powerful Women Award 2025 in the Education Sector acknowledging her contributions to academia and leadership in education.

Dr. Rekha Singh served as a Panelist in Round Table Conference on the theme “ Women in Leadership for Vikasit Bharat” organized by AIMS on 12th July 2025.

Dr. Rekha Singh, Dy. Director and Professor has been appointed as a reviewer for Vine Journal of Knowledge Management, ABDC “B” Category Journal.

Dr. Rekha Singh, Dy. Director and Professor has been appointed as a reviewer for research Papers at AIMS International.

Dr. Rekha Singh Dy. Director and Professor has been appointed as a reviewer for Asian Journal of Economics. Finance and Management.

Dr. Rekha Singh, Dy. Director and Professor has been invited as a Panelist at the HR Conclave organized by Women HR Association (WHRA) on 10th March, 2024.

Dr. Rekha Singh, Dy. Director and Professor has developed content and recorded Lectures for a course on “Public Personnel Administration” for UGC-MOOC platform-Swayam NPTEL in the year 2024.

Dr. Rekha Singh, Dy. Director and Professor has developed content and recorded Lectures for a course on “Comparative Public Administration” for UGC-MOOC platform-Swayam NPTEL in the year 2024.

Dr. Rekha Singh Dy. Director and Professor served as a Session Chair at Twentieth AIMS International Conference on Management organized at the Indian Institute of Management Kozhikode in January, 2023.

Dr. Rekha Singh, Dy. Director and Professor served as a session Chair for Global Summit on ESG and Sustainability AAROHAN 2.0 on 11th March, 2024.

Dr. Rekha Singh, Dy. Director and Professor has been appointed as a paper setter for the subject “International Human Resource Management” at Abdul Kalam Technical University, Lucknow.

Dr. Vishal Sandanshive, Professor-Finance was invited as a Resource Person for the MBA Innovation, Entrepreneurship, and Venture Development Program at Ganpat University, held from May 05, 2025 to June 05, 2025.

Dr. Vishal Sandanshive, Professor-Finance has been appointed as a Member of the Board of Studies under the Faculty of Commerce and Management at KCES’s Institute of Management Studies and Research, Jalgaon.

Dr. Vishal Sandanshive, Professor-Finance has been appointed as a Ph.D. Referee at KBC North Maharashtra University, Jalgaon, and Datta Meghe Institute of Higher Education & Research (Deemed to be University), Wardha.

Dr. Megha Sharma, Associate Professor, Finance was appointed as a Jury member and invited as a judge for oral presentations, in One day RUSA sponsored International Conference, organized by Patkar- Varde College, Mumbai on 13th January 2024.

Dr. Ramkrishna Dikkatwar, Professor-Marketing evaluated and monitored the progress of Ph.D scholars as an external subject expert in Research Advisory Committees of Sri Balaji University, Pune & Woxen University, Hyderabad.

Dr. Ramkrishna Dikkatwar, Professor-Marketing acted as reviewer for Emerald’s “International Journal of emergency services” (Indexed in Scopus Q2; Web of Science with Cite score = 2.5).Dr. Megha Sharma, Associate Professor, Finance was appointed as a Jury member and invited as a judge for oral presentations, in One day RUSA sponsored International Conference, organized by Patkar- Varde College, Mumbai on 13th January 2024.

Dr. Rahul Wagh, Associate Professor-Marketing has been invited as Resource Person at the 3rd One Week International Workshop on Entrepreneurship Development hosted by REC Azamgarh (Affiliated to Dr. A. P. J. Abdul Kalam Technical University, Lucknow). He delivered expert sessions on ‘Marketing Strategies for Startup Success’ and ‘Making Startups a Brand to aspiring entrepreneurs’.

Dr. Rahul Wagh, Associate Professor-Marketing received formal recognition from the Academy of Management (AOM) for serving as a Peer Reviewer for their prestigious Annual Meeting. Dr. Rahul Wagh was honored to contribute to advancing global management research and engage with a vibrant scholarly community.

Dr. Rahul Wagh, Associate Professor-Marketing has been appointed as the Paper Setter for various Marketing subjects at Dr. A.P.J. Abdul Kalam Technical University, Lucknow (AKTU).

Dr. Rahul Wagh, Associate Professor-Marketing has been appointed as a Ph.D. Thesis Examiner by KIIT Deemed to be University, Bhubaneswar, for research on “Women empowerment through SHGs using the Data Envelopment Analysis framework.

Dr. Charu Upadhyaya, Associate Professor, Finance has completed the project entitled “Cost Sheet Estimation and Projections” for Shree Mahakali Indusutries during February 2024 to March 2024. 07 MMS students (Batch 2023-25) also participated in the project.

Dr. Vishal Sandanshive, Associate Professor, Finance has completed the project entitled “Cost Sheet Estimation and Projections” for Ashwini Apparels & Properties Pvt. Ltd. during February 2024 to March 2024. 06 MMS students (Batch 2023-25) also participated in the project.

Ms. Patricia Lemos, Assistant Professor, Finance has acted as coordinator for the project with Shree Mahakali Indusutries and Ashwini Apparels & Properties Pvt. Ltd. During February 2024 to March 2024.

Mr. Rahul Mehta, Industry Connect In-Charge and Placement Head, has conducted training program on “Driving GM Strategies for Accelerated Business Growth” for the Opportune Technologies Pvt. Ltd. on 4th – 19th May 2023.

Ms. Reema Shah, Assistant Professor, Marketing, has acted as Co-Trainer in training program on “Driving GM Strategies for Accelerated Business Growth” for the Opportune Technologies Pvt. Ltd. on 4th – 19th May 2023.

Dr. Ramakumar Ambatipudi, CTO and Professor, Marketing has successfully completed the Consultancy Project for Deve Rus Services Advisory Private Limited for the period 2022-24. The consultancy project offered the services for Mahapreit Start up Knowledge Centre (MSKC), Mumbai.

Dr. Rekha Singh, Deputy Director and Associate Professor, HR has successfully completed the Consultancy Project for Soniya Gramudyog during November to December 2023. Dr. Singh contributed in the areas like skill gap identification and designing the training program, policy finalization and implementation, Analysis of Market survey for products.

Dr. Vishal Sandanshive, Associate Professor delivered a session on “Demystifying Financial Statements” in Winter School for “Finance for Non-Finance Professionals” on 28th Feb 2022. The session was organized by D. Y. Patil Business School, Pune in association with East Delta University, Bangladesh.

Dr. Vishal Sandanshive, Associate Professor was invited as Guest Speaker for a session on “An Intriguting Panel Discussion on Analysis of Union Budget 2022-23” on 4th Feb 2022 at Ajinkya D. Y. Patil University, Pune.

Prof. Rahul Mehta, Assistant Professor was invited to conduct a session on ‘Innovation in the Age of Disruption’ at Tarapur Management Association (TMA) Office in Boisar, Maharashtra on 21st February, 2019 for 40 participants on the occasion of the 13th National Management Day and the 63rd Foundation Day, TMA.

Dr. Shailendra Kale delivered a talk on 21st December on the theme ‘Lean Manufacturing’ at Tarapur Management Association. He shared various aspects of lean manufacturing practices and its possible impact on the overall performance in the manufacturing facilities. The talk was attended by senior executives of industry and members of TMA.

The teaching learning processes in the Institute has undergone changes and improvements over the past decade in context to contemporary practices by way of improvised tools and facilities including use of modern teaching methods, ICT etc. Classrooms are equipped with interactive panels, computers, internet, and other facilities. The computer labs are equipped with latest computer hardware and software. The seminar and conference rooms are fitted with modern facilities for online conferences, webinars, sessions, guest lectures. The Learning Resource Centre (library) has e-books, e-journals, and external institutional tie ups in addition to hard copies and facilities etc. The faculty use innovative teaching materials including videos, documentaries, simulation tools etc. The teaching learning process is not confined to only internal stakeholders. The external stakeholders too play an important role in this process. The Institute-Industry-Interaction has gained significance since the industry employing our graduates have a say in the contents of curriculum, methodology of teaching, experiential learning, and training inputs to get competent mindful leaders.

The faculty members have taken several initiatives to improve teaching and learning processes by using latest teaching tools for students’ enhanced learning. They have introduced experiential learning initiatives to enhance student engagement across Finance, Marketing, Operations, and Entrepreneurship. Activities such as stock audits, IPO analysis, Future Trading Simulations, Financial Modelling, and Technical Charting bridge classroom concepts with real-world applications. Students participate in industry visits, case studies, research projects, and panel discussions to develop critical thinking, financial literacy, problem-solving, and decision-making skills. Hands-on exposure to trading platforms, sectoral analysis, and investor decision-making ensures industry readiness. These initiatives foster a practical understanding of business environments, preparing students for successful careers through interactive learning and application-based projects.

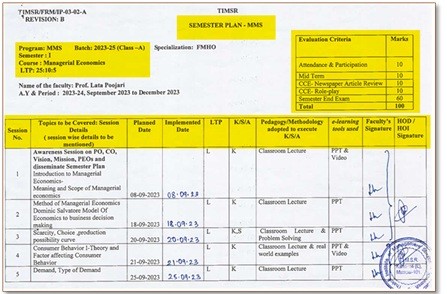

Some of the Course-specific Key Initiatives on Teaching-Learning taken by Faculty Members are summarized as below:

| Innovation Title | Name of Faculty | Relevant Courses | Objective | Description | Impact on Student Learning |

| Experiential Learning – Stock Audit Activity | Mahendra Daima | Material Management, Inventory Management, Management Resource Planning & Control | To provide hands-on experience in auditing processes, inventory management, and operational efficiency in a live warehouse setting. | Students participated in a stock audit at Maruti Suzuki and Bajaj Motors warehouses in collaboration with JHS & Associates LLP. They engaged in inventory control, stock verification, and operational assessments, bridging theoretical knowledge with real-world applications. | Enhanced student understanding of auditing, inventory management and financial integrity. Strengthened problem-solving, analytical, and industry-relevant skills for careers in finance, operations, and supply chain management |

| Simulation for Optimization in Manufacturing | Anmol Dixit | World Class Management | To help students understand process optimization, bottleneck identification, and efficiency improvement in manufacturing systems. | Students used simulation software to model real-world manufacturing scenarios. They analysed production workflows, identified inefficiencies, and optimized processes using Lean and Six Sigma principles. | Strengthened problem-solving and decision-making skills. Provided hands-on experience with industry-grade simulation tools. Enhanced students’ ability to apply theoretical concepts to real-world manufacturing challenges. |

| Experiential Learning – PADYATRA Activity | Dr. Yesha Mehta and Dr. Reema Shah | Marketing Management, Entrepreneurship Management, Marketing Strategies, Consumer Behaviour | To provide students with real-world exposure to small-scale business operations and management practices. | Students visited small independent restaurants and shops around Kandivali (East) to observe and learn business management lessons. They interacted with business owners, observed customer behaviour and analysed promotional activities. | Strengthened students understanding of small business management, operations, and marketing strategies. Improved observational, analytical, and reporting skills through direct engagement and report preparation. |

| Focus Group Activity | Dr. Charu Upadhyaya, Dr. Megha Sharma | Business Research Methods | To provide students with hands-on experience in conducting qualitative research and analyzing real-world business scenarios. | Students were organized into small groups, with a moderator assigned to each group. The moderator selected a product or service and crafted open-ended questions for focus group discussions. After discussions, the moderator transcribed and analysed qualitative data, identifying patterns to draw meaningful conclusions. | Enhanced students understanding of qualitative research methods, critical thinking, and analytical skills. Strengthened communication and teamwork skills, preparing students for business research challenges. |

| Exploring Shopper Behaviour: An Observational Study of Retail Malls | Dr. Charu Upadhyaya, Dr. Megha Sharma | Business Research Methods | To analyse product placement strategies and shopper behaviour in retail malls through direct observation. | Students conducted an observational study in Mumbai retail malls to examine brand strategies, product placements, and shopper behaviours. They worked in teams to document marketing strategies and consumer engagement patterns. | Strengthened students analytical and observational skills, deepened understanding of marketing strategies, and improved teamwork and participative learning with real-world applications. |

| MOCK STOCK: Dynamics of Stock Market Trading | Dr. Charu Upadhyaya, Gunwant Awasthi | Derivatives and Risk Management, Security Analysis and Portfolio Management, Financial Markets and Institutions | To provide students with an understanding of financial planning and virtual stock trading. | A workshop conducted in association with ICICI Direct featuring guest speaker Mr. Mayank Savla. Students received training on ‘STOCK MIND,’ a virtual trading platform, learning stock market dynamics and trading strategies. | Enhanced financial literacy, improved stock market awareness, and bridged the gap between industry and academia through interactive learning. |

| Bizdom – Social Entrepreneurship Quiz Competition | Gunwant Awasthi and Aashish Kumar | Entrepreneurship Management | To inculcate knowledge about the recent business environment and current trends in business. | Students participated in a quiz competition designed to test their knowledge of social entrepreneurship. Teams of two competed in answering business-related questions, improving their strategic thinking, teamwork, and decision-making skills. | Strengthened students’ understanding of social entrepreneurship, enhanced teamwork and time management skills, and provided exposure to current business trends. |

| Business Week – Panel Discussion on Challenges & Opportunities of SMEs | Gunwant Awasthi and Aashish Kumar | Entrepreneurship Management | To provide students with an in-depth understanding of the SME sector, including its challenges, opportunities, and government support. | Students participated in a panel discussion based on insights gained from interviews with SME owners and managers during Business Week. Discussions covered SME sector opportunities, threats, and regulatory support. | Strengthened students’ knowledge of SME operations, improved their critical thinking and communication skills, and enhanced their ability to analyse business challenges and opportunities. |

| Conclaves: Building Bridges, Fostering Management Skills | All Faculty Members | All Courses | To facilitate dialogue and collaboration between industry experts, academic scholars, and students, while developing leadership, teamwork, and critical thinking. | Conclaves involve structured panel discussions where industry experts, academicians, and students discuss evolving business practices, industry challenges, and trends. Themes focus on topics like customer centricity, sustainability, risk management, and digital transformation. The event encourages experiential learning, networking, and knowledge sharing. | Enhanced leadership, teamwork, and critical thinking skills. Improved industry exposure and networking opportunities for students. Strengthened problem-solving and analytical skills through real-world discussions. |

| Sectoral Analysis using ACE Equity | Lata Poojari, Dr. Megha Sharma | Financial Management and Analysis of Financial Statements, Corporate Valuation | To provide students with hands-on experience in analyzing sector-wise financial data using ACE Equity software. | Students were introduced to ACE Equity, a financial database tool, to study sectoral trends, company performances, and market insights. They analysed financial statements, industry benchmarks, and macroeconomic indicators for decision-making. | Strengthened students’ financial analysis and data interpretation skills. Provided real-world exposure to financial modeling, investment analysis, and sectoral performance evaluation. |

| Visit to National Stock Exchange (NSE), Securities Exchange Board of India (SEBI) | All Faculty Members | Courses related to Finance Domain | To provide students with valuable insights into stock market operations and financial instruments, helping them make informed career choices. | Students visited the NSE, SEBI where sessions were conducted by experts on stock exchange functioning, financial instruments, and regulators role in the Indian economy. | Improved financial literacy and practical understanding of stock markets. Encouraged career exploration in finance and investment sectors. |

| HBR Article Review in Economics | Lata Poojari | Managerial Economics | To enhance students critical thinking and analytical skills by engaging with real-world economic issues discussed in HBR articles. | Students were assigned Harvard Business Review (HBR) articles related to economics, covering topics like macroeconomic trends, market disruptions, and policy impacts. They presented critical reviews, summarizing key insights and connecting them with economic theories. | Improved analytical and comprehension skills. Strengthened students’ ability to relate theoretical economic concepts to real-world business scenarios. Encouraged critical evaluation of economic policies and market trends. |

| Caselets Developed in Economics | Lata Poojari | Managerial Economics | To enhance students ability to apply economic theories to real-world business scenarios through case-based learning. | Students developed short caselets based on contemporary economic events and business challenges. Students analysed the cases, identified key economic principles, and proposed solutions using economic frameworks. | Strengthened problem-solving, critical thinking, and decision-making skills. Encouraged application of theoretical concepts to practical business problems. Enhanced engagement through interactive |

| Data Visualization Activity using Atlas of Economic Complexities | Dr. Vishal Sandanshive | International Business | To enable students to analyse global trade patterns, economic growth, and industrial development through data visualization. | Students used the Atlas of Economic Complexity, an interactive tool developed by Harvard, to visualize economic data, explore trade relationships, and assess industrial capabilities of different countries. They worked on real-time datasets to interpret economic trends. | Enhanced analytical and research skills. Improved ability to interpret complex economic data and trends. Strengthened decision-making by applying data-driven insights. |

| Cost Sheet Estimation and Projections | Patricia Lemos, Dr. Charu Upadhyaya, Dr. Vishal Sandanshive | Cost and Management Accountancy | To provide students with real-time exposure to cost estimation, budgeting, and financial projections through live industry data. | Students collaborated with small businesses and start-ups to prepare live cost sheets based on actual financial data. They worked on material costing, labour costs, overheads, and profit projections using Excel and financial software. | Strengthened analytical skills, decision-making, and real-world financial acumen. Provided hands-on experience in cost estimation, pricing strategies, and financial forecasting. |

| Vouching Project | Mahendra Daima | Material Management, Inventory Management, Supply Chain Management | To provide students with practical exposure to vouching, verifying financial transactions, and ensuring compliance with accounting standards. | Students engaged in live vouching exercises by auditing real business transactions, verifying source documents (invoices, receipts, payment vouchers), and ensuring accuracy in financial records. The activity was conducted in collaboration with small firms and accounting professionals. | Improved understanding of auditing procedures, fraud detection, and compliance. Strengthened students analytical and decision-making skills with hands-on industry experience. |

| Students Research Publications in Conference | All Faculty Members | All Courses | To encourage students to engage in academic research, develop critical thinking, and contribute to knowledge creation. | Students conducted research on contemporary business and management topics under faculty guidance. Research papers were presented at national and international conferences, fostering a research-oriented mind-set. | Enhanced students’ analytical, writing, and presentation skills. Increased exposure to academic research and networking opportunities with industry and academia. |

| Visit to Labour Court | Dr. Pooja Thorat | Labour Laws | To provide students with real-world exposure to labour law proceedings and dispute resolution mechanisms. | Students visited the Labour Court at BKC, Mumbai, accompanied by a practicing lawyer and faculty. They observed the filing process, legal arguments, and a live hearing of an employee retrenchment case. | Enhanced understanding of labour laws, dispute resolution processes, and practical legal applications in HR. Strengthened analytical and legal reasoning skills. |

| Visit to Industry-Specific Exhibitions at Bombay Exhibition Center | All Faculty Members | All Courses | To expose students to the latest advancements in automation technology and smart manufacturing. | Students visited the India Rubber Expo, Automation Expo, Textile Expo etc. at the Bombay Exhibition Centre, engaging in discussions, attending seminars, and interacting with industry professionals. They explored emerging trends, new technologies, and business strategies in the industry. | Strengthened industry exposure, provided practical insights into supply chain and operations management, and enhanced networking skills. Helped bridge academic learning with real-world industry developments. |

| Business Venture Vault (BVV) – National Level Business Plan Competition | Gunwant Awasthi, | Entrepreneurship Management, Financial Management | To encourage entrepreneurial thinking and provide students with an opportunity to pitch innovative business ideas. | A National Level Business Plan Competition where MMS students, along with their teams, developed and presented innovative business ideas. | Strengthened entrepreneurial mind-set, improved business acumen, and enhanced pitching & presentation skills. Encouraged strategic planning, innovation, and teamwork. |

| Aashish Kumar | |||||

| National Level Summer Internship Project Competition | All Faculty Members | Summer Internship Project | To provide a platform for students to showcase their summer internship projects and gain industry exposure. | A national-level competition where students presented their internship projects, highlighting innovative solutions and industry best practices. Participants from Mumbai and other regions competed, with industry experts evaluating their work. | Enhanced presentation skills, industry exposure, and practical learning. Strengthened students’ ability to analyse real-world business problems and propose viable solutions. |

| Decoding an Annual General Meeting (AGM) | All Faculty Members | Courses related to Finance Domain | To enhance students understanding of corporate governance, leadership strategies, and financial performance analysis. | Students analysed the AGM of Reliance Ltd. through a recorded video screening. Post-session, they filled out a Google Form detailing their key takeaways regarding financial performance, leadership decisions, and corporate strategy. | Strengthened students’ ability to critically evaluate corporate governance practices. Improved analytical and decision-making skills by engaging with real-world corporate proceedings. |

| Aptitude Test, Mock Group Discussion, and Mock Personal Interview | Dr. Sonal Sharma | Personal Grooming and Personal Effectiveness | To enhance students’ employability skills by improving problem-solving abilities, communication, and interview preparedness. | A structured program was conducted where students participated in aptitude tests assessing logical reasoning, quantitative, and verbal skills. This was followed by Mock Group Discussions (GD) to develop articulation, teamwork, and critical thinking. Lastly, students underwent Mock Personal Interviews (PI) with faculty and industry experts to refine their responses, body language, and confidence. | Enhanced problem-solving, analytical reasoning, and communication skills. Improved confidence and interview performance, preparing students for recruitment processes. |

| Simulation of Option Trading Strategies using NSE and Online Simulations | Dr. Charu Upadhyaya | Derivatives and Risk Management | To provide students with real-time exposure to stock market trends, trading mechanisms, and financial instruments. | Students actively analysed live stock market data using the NSE website. They studied key indices, stock movements, trading volumes, and market trends. Faculty guided them on interpreting stock charts, financial ratios, and economic indicators affecting market fluctuations. | Improved financial literacy and real-time market analysis skills. Enhanced students ability to make data-driven investment decisions and understand stock market dynamics. |

| Experiential Learning through Role-play in Managerial Economics | Lata Poojari | Managerial Economics | To help students bridge the gap between theoretical economic concepts and real-world business scenarios through interactive role-plays. | Students were assigned different roles such as business owners, policymakers, and market analysts. Through structured role-plays, they simulated real-world economic scenarios like demand-supply shifts, price elasticity, market structures, and government interventions. Faculty facilitated discussions to connect role-plays outcomes with economic theories. | Enhanced students analytical thinking, problem-solving skills, and ability to apply economic concepts in business decision-making. Strengthened teamwork, communication, and negotiation skills. |

| Building of Financial Models | Lata Poojari | Financial Modelling, Analysis of Financial Statements, Financial Management | To equip students with hands-on experience in creating financial models for real-world businesses and start-ups. | Students developed financial models by analyzing existing businesses or new start-ups ventures. They worked with real-time financial data to construct income statements, cash flow projections, valuation models, and sensitivity analyses. Faculty provided mentorship to ensure practical applicability and accuracy. | Strengthened students proficiency in financial analysis, decision-making, and investment evaluation. Enhanced critical thinking, Excel skills, and real-world financial problem-solving abilities. |

| Industry Analysis Report Writing for Financial Models | Lata Poojari | Financial Modelling, Analysis of Financial Statements, Financial Management | To provide students with a comprehensive understanding of industry trends, challenges, and financial feasibility. | After developing financial models, students conducted industry research, analyzing key market trends, competitors, risks, and economic factors. The findings were compiled into structured reports that complemented their financial models, providing a holistic perspective. | Enhanced students research and analytical skills, deepened their industry-specific financial knowledge, and improved their ability to present structured financial insights. |

| Presentation on Financial Analysis of a Listed Company | Lata Poojari | Analysis of Financial Statements, Financial Management | To enable students to apply financial management concepts to real-world corporate financial statements. | Students selected a publicly listed company, analysed its financial statements using key financial ratios and valuation techniques, and prepared a presentation to discuss their findings. They examined profitability, liquidity, solvency, and market valuation metrics. | Improved financial literacy, analytical reasoning, and decision-making skills. Strengthened students ability to interpret financial data and present insights effectively. |

| Discussion on Financial Analysis Report of Gopal Snacks IPO | Lata Poojari | Financial Management, Analysis of Financial Statements | To apply financial management concepts to evaluate the IPO of Gopal Snacks and enhance decision-making skills. | Students conducted an in-depth analysis of the financials of Gopal Snacks, examining key financial metrics, risk factors, and valuation parameters. The discussion focused on evaluating the companys strengths, weaknesses, and IPO pricing strategies. | Strengthened students ability to interpret financial data, assess investment risks, and apply financial concepts to real-world scenarios. Encouraged critical thinking and informed decision-making. |

| Project on Future Trading – Creating and Managing a Trading Portfolio | Dr. Charu Upadhyaya | Derivatives and Risk Management | To provide hands-on experience in derivatives trading, risk management, and mark-to-market settlement. | Students created their own Future Trading Account Portfolio, taking both long and short positions in different securities. They tracked their trades, maintained daily mark-to-market (MTM) settlements, and analysed profit & loss fluctuations based on market movements. | Enhanced students understanding of futures contracts, margin requirements, hedging strategies, and risk management. Developed real-world trading skills and decision-making abilities. |

| Technical Charting & Beta Calculation using Yahoo Finance | Dr. Charu Upadhyaya | Derivatives and Risk Management | To develop students’ understanding of stock market trends, risk assessment, and financial modeling using technical indicators. | Students utilized Yahoo Finance to create technical charts of securities (candlestick charts, moving averages, RSI, MACD). They also calculated Beta by tracking daily closing prices of stocks and comparing them with market index movements. | Strengthened quantitative finance skills, risk analysis techniques, and market trend forecasting. Enabled students to apply theoretical financial concepts in a real-world setting. |

| Investor Decision-Making through Annual Report Analysis | Dr. Shebazbano Khan | Financial Accounting | To help students evaluate the financial health and investment potential of a company by analyzing its annual report. | Students selected a publicly listed company, reviewed its annual report, and analysed key financial metrics such as profitability, liquidity, solvency, and valuation ratios. They examined management discussions, corporate governance reports, and future business outlook to determine whether to invest. | Enhanced students’ financial literacy, critical thinking, and decision-making skills. Enabled them to apply fundamental analysis techniques to real-world companies, bridging the gap between theory and practice. |

| Country Risk Analysis – Experiential Learning | Dr. Vishal Sandanshive | International Business | To enable students to assess the economic, political, and financial risks of investing or expanding business in a foreign country. | Students used online sources such as Trading Economics, World Bank Reports, and Global Risk Indexes to evaluate country-specific risks. They analysed factors like currency stability, inflation, political stability, and trade regulations and participated in a classroom discussion based on their findings. | Improved understanding of global financial risks, investment decisions, and macroeconomic indicators. Strengthened analytical skills and ability to interpret global business environments. |

| Analyzing and Commenting upon the Upcoming IPO | Lata Poojari, Dr. Megha Sharma | Financial Management | To enable students to analyse Initial Public Offerings (IPOs) using fundamental and financial concepts for real-world investment decision-making. | Students researched an upcoming IPO using SEBI filings, financial statements, and market reports. They assessed company valuation, financial ratios, market conditions, and risks. Based on their analysis, students prepared investment recommendations and participated in a group discussion. | Enhanced financial analysis, valuation skills, and critical thinking. Improved ability to interpret financial reports and make informed investment decisions. Strengthened understanding of capital markets and IPO mechanisms. |

| Ideation till Pitch Deck | Aashish Kumar | Entrepreneurship Management | To create a viable business plans by students which can fetch funding in future. | Students presented Business Plans from idea generation to the pre-commercialization concept. | Students learned real business scenarios with, which will help them to future entrepreneurs. |

Initiatives available on Public Domain:

| Name of Faculty | Initiatives on Teaching – Learning | ||

| Platform | Details of Content | Link | |

| Dr. Ramakumar Ambatipudi | NPTEL SWAYAM | Instructor in Public Personnel Administration | VIEK LINK |

| Dr. Shuchi Gautam | NPTEL SWAYAM | Accountability and Control Machinery of USA | VIEW LINK |

| Dr. Rekha Singh | YouTube | Lectures on Performance Management System | VIEW LINK |

| Dr. Rekha Singh | NPTEL SWAYAM | Accountability and Control Machinery of UK, Employee Union | VIEW LINK |

| Dr. Vishal Sandanshive | YouTube | Academic Video Content | VIEW LINK |

| Dr. Vishal Sandanshive | Blog | Academic e-Content | VIEW LINK |

| Dr. Yesha Mehta | YouTube | Session on Digitalization: Branding You! | VIEW LINK |

| Dr. Truptii Shelke | NPTEL SWAYAM | Local Governmental Systems in USA | VIEW LINK |

Faculty Initiatives to promote the Students Research Publications: (Link: VIEW)

Common initiatives taken by the faculty members:

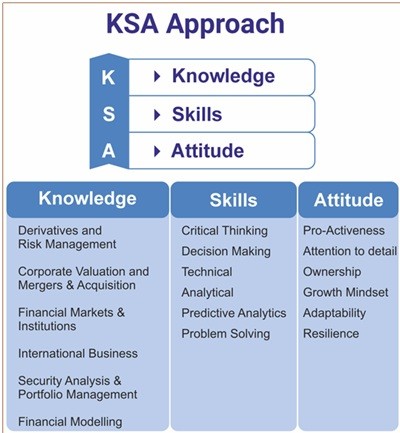

- Knowledge, Skills and Attitude Approach in each course (Document Link: VIEW)

- Innovative Guest Session Mechanism / Delivery (Website Link: VIEW)

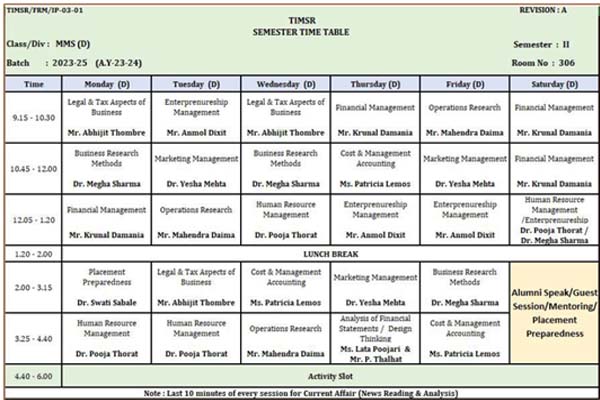

- Structured Mentoring by Faculty and Alumni (Website Link: VIEW)

- Pre-placement coaching (Website Link: VIEW)

- Activities of Learning Resource Center such as Library session, Library Quiz etc. (Website Link: VIEW)

- Value Added and Certification Program (For e.g. Financial Modelling, Analysis of Financial Statements, Emerging Trends in Marketing, Design Thinking etc.) (Website Link: VIEW)

- Use of ICT tools for class engagement (Document Link: VIEW)

Resources available in the Institute for Innovative Teaching-Learning Practices:

- TIMSR Research Cell (Website Link: VIEW)

- TIMSR Centre for Entrepreneurship & Innovation (TCEI) (Website Link: VIEW)

- TIMSR FinTech Lab (Website Link: VIEW)

- TIMSR Social Responsibility Cell (SAMVEDNA) (Website Link: VIEW)

- TIMSR Student Council (Website Link: VIEW)

- TIMSR Learning Resource Center and Digital Library (Website Link: VIEW)

- Classrooms equipped with Interactive Panels (Smart Board)

- Virtual Classroom

- Discussion Room

Database and Software available in the Institute to support Teaching-Learning Initiatives:

- ACE Equity Database

- Statistical Package for Social Science (SPSS)

- ProQuest

- EBSCO

- Turnitin

- R Programming

- Power BI

- Tableau

- MOOC Courses

Encourage and guide the students to organize events and activities: (Website Link: VIEW)

- Conclaves

- International Conference

- FEST – YUVOSTAV

- National Level Summer Internship Competition

- Seminar, Workshops and Guest Sessions

- Activities of Social Responsibility Cell (SAMVEDNA)

- Activities of Student Council

Review Mechanism on Faculty Initiatives

The above-mentioned course-specific and common initiatives taken by faculty members are available on Institute’s Website and course file. The initiatives are also discussed in the regular meetings and communicated to the students during induction, orientation and classroom sessions. All the initiatives are supported with the ICT, instructional delivery methods and available resources. The initiatives are regularly assessed and evaluated and results and feedback are shared with the students for further improvement. The initiatives are regularly reviewed, updated and re-developed as per the requirements.

Outcome of Faculty Initiatives

- Enabling the students to make informed investment and business decisions

- Hands-on experience helps to bridge the gap between theory and practice

- Improving problem-solving, critical thinking and decision-making abilities of students

- Improving communication and presentation skills

- Preparing students for collaborative work environments

- Increasing industry exposure and networking opportunities

- Connecting students with real-world professionals and current business trends

- Fostering entrepreneurial thinking and innovation

- Developing research, observational and reporting skills

- Enhancing student’s ability to analyse and communicate complex business data

- Developing understanding of Finance, Operations, Marketing and HR

- Enabling student’s analytical skills with the application of economic legal and corporate governance concepts in real-world contexts

- Improving policy evaluation and compliance understanding

- Encouraging leadership development, time management and strategic thinking

Glimpses of Innovative and Effective Pedagogical Initiatives:

|  |  |

Figure 1: Experiential Learning Activity: PADYATRA | Figure 2: Domain Specific Conclaves | Figure 3: Experiential Learning Activity: Exploring Shopper Behaviour: An Observational Study of Retail Malls |

|  |  |

Figure 4: Library Sessions | Figure 5: TCEI activities | Figure 6: FinTech Lab |

|  |  |

Figure 7: Ideation till Pitch Deck: Presentation of Business Plan by Students | Figure 8: Going Beyond Classroom Learning: A Visit to LaxmiGyaan! – Cost Sheet Estimation and Projections | Figure 9: Stock Audit : Students participated in an Experiential Learning Activity in collaboration with JHS & Associates LLP |

|  |  |

Figure 10: Session on Value Added Courses | Figure 11: Screenshot of First Page of Semester Plan highlighting the KSA and its execution | Figure 12: KSA Approach in Teaching – Learning |

|  | |

Figure 13: Time Table highlighting Mentoring / Placement Preparation / Alum Speak Sessions | Figure 14: Resource Persons in Guest Sessions |